STEP 1: What is the Employee Retention Tax Credit Refund (ERC)

Millions of business owners were negatively affected by COVID 19. Mandatory shutdowns, changes to your business operation, supply chain shortages, how you served your customers, etc. are just a few of the many problems business owners faced in 2019, 2020 & 2021. Many business owners are still feeling the affects. To provide relief to businesses throughout the United States Congress passed the CARES Act (Coronoavirus Aid, Relief & Economic Security.) The Employee Retention Tax Credit Refund (ERC) is part of the CARES Act. Any eligible business can receive a refund up to $7,000 per employee kept on W2 payroll for each quarter 1, 2, & 3 of 2021; for a maximum total of $21,000 PER W2 employee.

The ERC refund is NOT a loan; you do DO NOT have to pay it back and there is NO interest rate attached to it.

If you took PPP money for your business during COVID (Rounds 1 and/or Round 2) you can still qualify for the ERC refund.

Unlike the PPP funds you received during COVID which the government said you have to use these funds specifically for payroll and/or rent; with the ERC refund YOU CAN USE THE MONEY FOR ANYTHING YOU LIKE.

STEP 2: Does your business qualify for the ERC refund? 3 Options/Ways to Qualify your business for ERC:

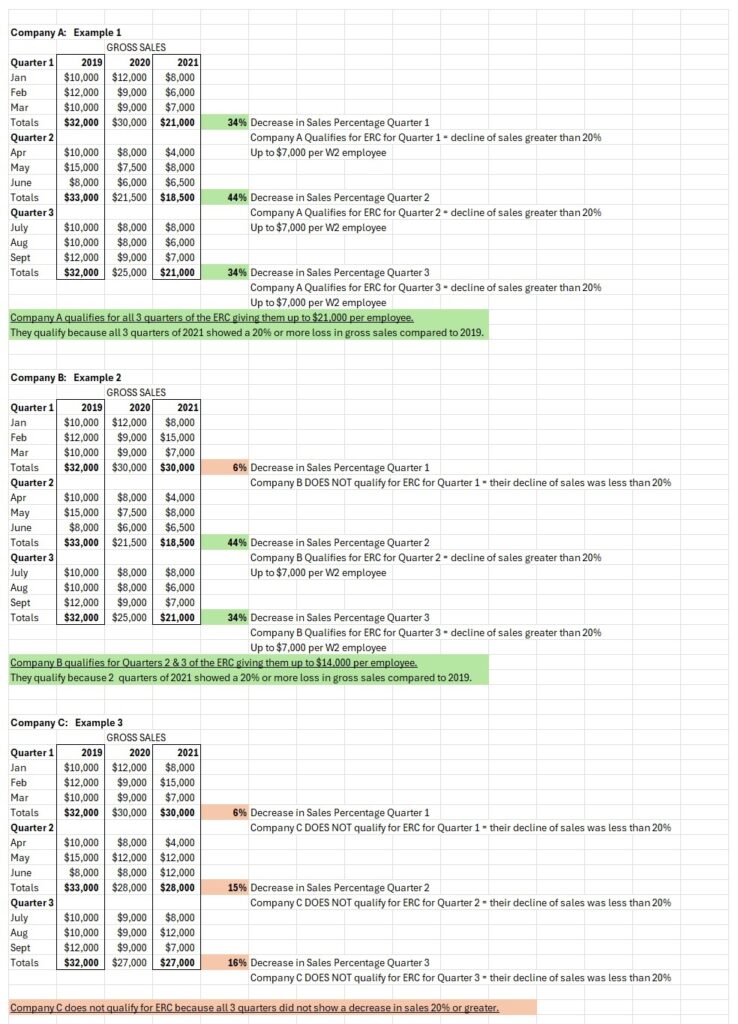

OPTION 1: GROSS SALES LOSS of 20% in 2021 compared to your 2019 gross sales per quarter.

If you had a 20% or more decrease in sales you 100% qualify for the ERC. There is absolutely no reason you shouldn’t file for the ERC refund. Let’s look at some examples:

EASIEST WAY TO QUALIFY.

OPTION 2: Full or Partial Suspension of operations due to government order due to COVID-19.

If your business was affected by a Federal, State or City (government) COVID ORDER due to COVID 19. For example, gyms, hair salons, churches, non profits, daycares, etc. many were impacted by Federal & State shutdown orders for COVID due to the “limitations of in-person gathering or interaction”. If a governmental order impacted your business and your business’s ability to generate income you may still qualify for the ERC refund. For example, many states required restaurants to distance tables of indoor dining 6 feet or more which greatly reduced the amount of patrons they can service at a one time. A restaurant could have had 30 tables but due to the “6 feet rule” went down to 15 tables. Some restaurants were not allowed to do in person dining at all which greatly impacted their ability to serve customers and generate income; limiting them to only carry out. Gyms and hair salons; many were closed down completely. Many non profits couldn’t fundraise by hold group meetings and events.

OPTION 3: You started a NEW business & started selling or serving the public after February 15, 2020. (Referred to as an “ERC Start Up Filing”)

For business owners that started their NEW business after February 15, 2020 you can file for the ERC refund without having a decline in gross sales or covid shutdown order. It is simply determined if you started serving or selling to the public after February 15, 2020. This is because starting a new business during COVID 19 was very difficult. It allows up to $7,000 per employee per quarter for quarters 3 & 4 of 2021. A cap is set of $100,000 if you are filing as an ERC startup, so the maximum amount you can receive is up to $50,000 for Quarter 3 of 2021 & up to $50,000 for Quarter 4.

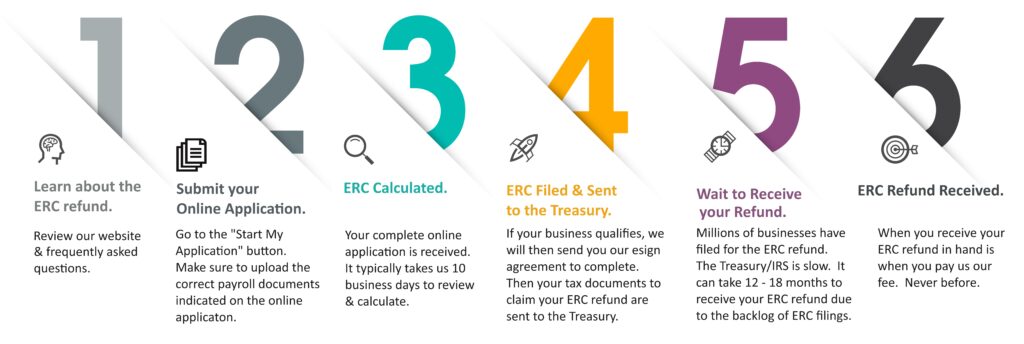

STEP 3: OUR PROCESS FILING for the ERC:

#1. Go to the “START MY APPLICATION” Button. It will take you to a list of questions that will help us determine your ERC refund and the amount you could receive.

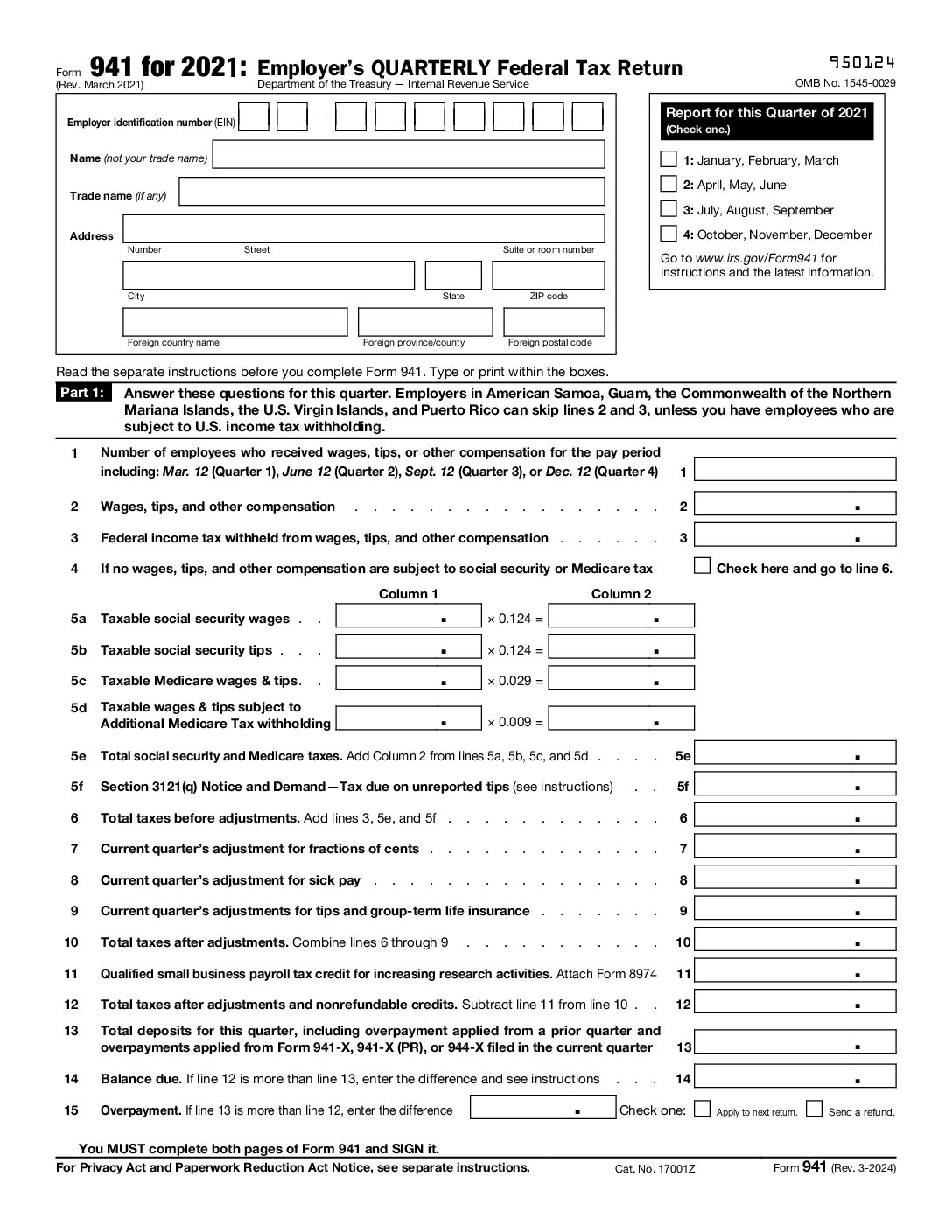

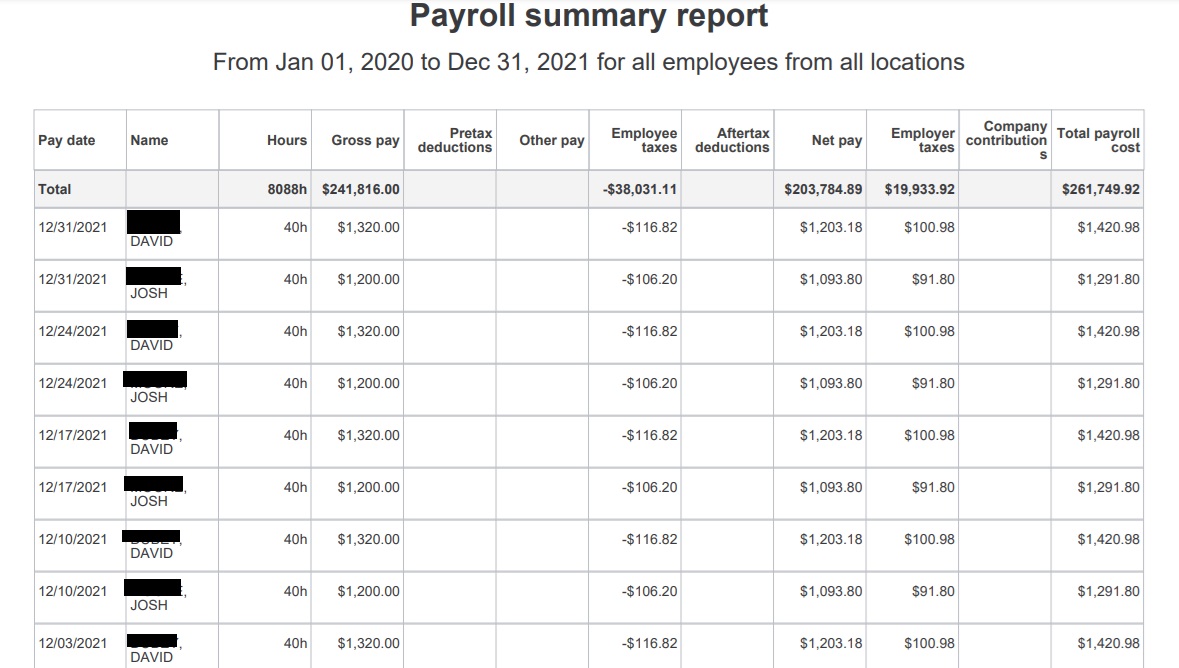

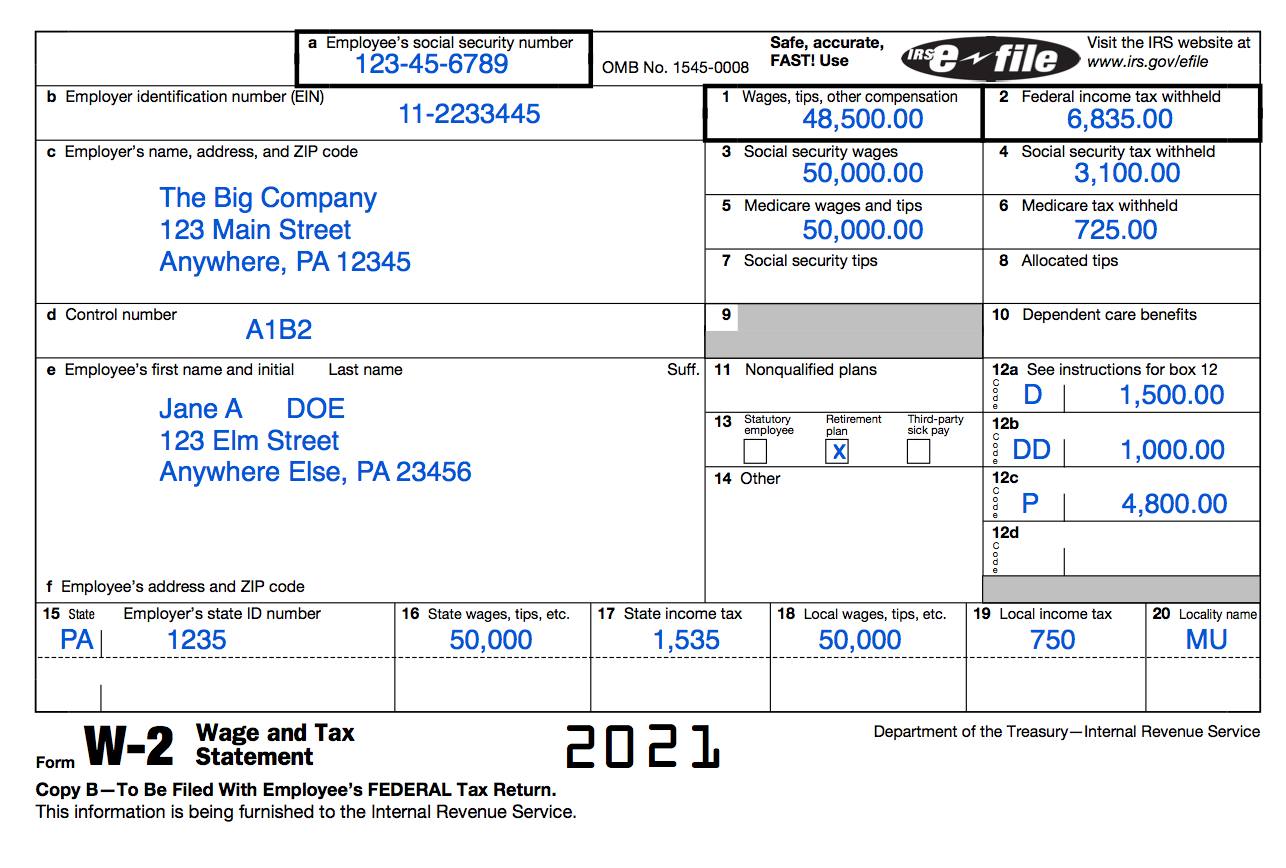

#2. At the end of the application, it will ask you to upload copies of your 941 QUARTERLY Payroll Filings for Quarters 1, 2, 3 & 4 for 2021. It will ask you to upload a MONTHLY payroll report for each month, January – December for 2021. The last set of documents we need are the W2’s for all your employees of 2021; we do not need the social security numbers on the W2’s; you can cross them. We need ALL these documents to complete an accurate ERC calculation.

CLICK HERE to see an example of what a 941 QUARTERLY PAYROLL FORM looks like. If you use a payroll provider, you can download these 941 forms typically from your online payroll account or request your payroll provider to send you copies of all 4 quarters of your 941’s for 2021 year. If you don’t use a payroll processing company for your payroll then you would request your 4 quarters of your 941 for 2021 from your accountant/tax preparer.

A QUARTERLY 941 FORM is typically 2 – 3 pages for each quarter. When you upload your 941 forms include ALL PAGES.

CLICK HERE, to see an example of a MONTHLY PAYROLL REPORT. The payroll report CAN NOT be YEARLY totals, we need to see MONTHLY payroll numbers. A payroll summary report or employee detail report, if you enter the data range 1/1/21 – 12/31/21, should show all individual payroll checks/payments made per employee.

CLICK HERE to see an example of an employee W2 FORM.

#3. Once you submit your complete online application our team will complete the calculations for the ERC refund. It typically takes us less than 10 business days to complete as long as you submit a complete application with the correct uploaded documents.

The beautiful part of this process is you pay NOTHING upfront. Once the calculations & review is completed, we will email you what ERC refund amount.. Here’s the 2 possible outcomes:

OUTCOME A:

We inform you after reviewing your application and uploaded documents that your ERC calculated was $0. We delete your information and file. Again, nothing is billed to you whatsoever.

OUTCOME B: WHAT WE HOPE!

After reviewing your application & running your calculations, we information you of your ERC refund amount. (Ex: $105,000 based on 5 qualified W2 employees.) Your file will be assigned to a customer service representative & they will email you our service agreement to complete; which gives us permission to process your file.

STEP 4: YOUR Business’s ERC Refund is calculated: FINAL STEPS

#4. A customer service representative will be assigned to your file to answer any questions you have. They will send you our service agreement to esign.

#5. E-Sign our service agreement. Our service agreement gives us permission to work on your file. Also, it clearly outlines our FEE for our services. We get paid NOTHING upfront, we simply collect a percentage of what you receive once you receive your ERC refund in hand. Our fee is based on the total number of qualified W2 employees you have.

For companies with 50 – 500 qualified W2 employees, we charge 15% of the Total Gross ERC Refund received.

For companies with 30 – 49 qualified W2 employees, we charge 20% of the Total Gross ERC Refund received.

For companies with 4 – 29 qualified W2 employees, our fee is 25% of the Total Gross ERC Refund received.

For companies with 1 – 3 qualified W2 employees, our fee is 33% of the Total Gross ERC Refund received.

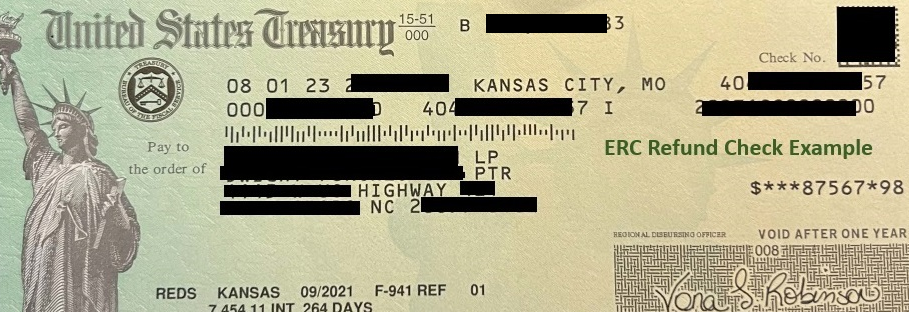

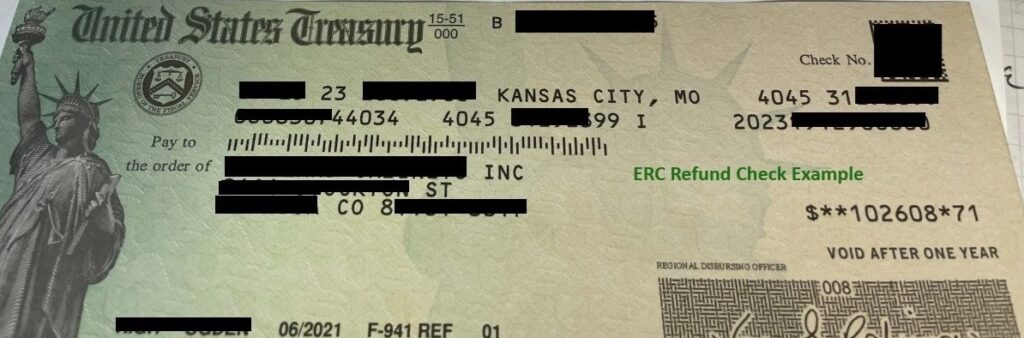

For example, John’s company has 4 qualified employees and after calculation their ERC refund is $84,000. John’s ERC refund documents are submitted. The IRS/Treasury as of July 2024, on average takes 12 – 18 months to process John’s ERC file. John receives his ERC refund check in the mail ($84,000 was filed plus the IRS/Treasury will ADD interest onto the refund); so the TOTAL ERC John receives is $92,000. John notifies us via email he received his refund, he sends us a picture of the check(s) received to verify the amounts paid to him are accurate and then we will invoice John 25% of the Total Gross ERC refund received in this example of $92,000. Our fee is paid to us after John receives his ERC refund check in hand and it clears in his bank account.

After your service agreement is e-signed; then your customer service representative will then send you the documents to sign for your ERC filing. They will email you the documents, you will need to print out, sign and then mail back to our office. Once we receive them back from you, we will then mail your documents to the Treasury and provide you with the tracking information.

Now we wait. Once we have sent your ERC refund filing to the Treasury/IRS it typically takes the government 12 – 18 months to review your file and mail you your refund. There has been a tremendous backlog of ERC filings; the latest news report stated over 1.25 million businesses have filed for the ERC refund and are still waiting for their ERC refund; with almost 20,000 new ERC filings every week. We have no control over the processing speeds of the Treasury/IRS and how fast they process your file. Remember, your ERC refund gets sent to you directly; nothing comes to us. We want you paid so we can then get paid for our work; our interests are 100% aligned. When the ERC refund program first came out years ago it was funding in as little as 4 months, in the beginning of 2023 it was averaging 6 – 8 months, but now the average processing time again is 12 – 18 months; the government/IRS is very backlogged. Your ERC filing may process quicker than 12 month or it may take longer than 18 months; 12 – 18 months is the industry average right now. Waiting for your refund requires patience and understanding we have no control over how fast the government/IRS/Treasury processes your file.

Start My Application

How much does 1800ERC.COM charge for their ERC Services?

We do not charge any upfront fees whatsoever. We will not ask you for a credit card or any forms of payment upfront. Our fee is a percentage of your received total gross refund based on the total number of qualified W2 employees your business had in 2021. We get paid AFTER you have received your ERC refund in hand.

For companies with 50 – 500 qualified W2 employees, we charge 15% of the Total Gross ERC Refund received.

For companies with 30 – 49 qualified W2 employees, we charge 20% of the Total Gross ERC Refund received.

For companies with 4 – 29 qualified W2 employees, we charge 25% of the Total Gross ERC Refund received.

For companies with 1 – 3 qualified W2 employees, we charge 33% of the Total Gross ERC Refund received.

Is the ERC refund a loan?

The ERC refund is NOT a loan. There is no interest rate attached. You can use the money any way you like.

Do I qualify for the ERC refund if I took the PPP funds during COVID in 2020 & 2021?

Yes, you may qualify for the ERC refund even if you took PPP funds during COVID. On December 27, 2020, Congress modified the ERC credit rules to the CARES ACT. It allows companies that took PPP money to still qualify for the ERC refund. However, the calculation of ERC refund you would receive is then calculated differently and PPP funds must be taken into account. Our online application asks you to include how much PPP you received (total $ value ex: $52,000) and the date it was forgiven (example 4/15/20) as almost all PPP funds were forgiven and not required to be paid back.

How long does the ERC process take from when apply online to when I receive my refund in hand?

The overall process of calculating the ERC refund typically takes about 10 business days once your complete online application is submitted. We will notify you via email and what the ERC refund amount would be (example: $105,000).Once we have sent your ERC refund filing to the Treasury/IRS it typically takes the government 12 – 18 months to review your file and mail you your refund. Your refund does NOT get mailed to us; your refund get’s mailed to your business address. There is a tremendous backlog of ERC filings; the latest news report stated over 1.25 million businesses have filed for the ERC refund and are still waiting for their ERC refund; with almost 20,000 new ERC filings every week as well. We have no control over the processing speeds of the IRS and how fast they process your file. We want you paid so we can then get paid for our work; our interests are 100% aligned. When the ERC refund program first came out years ago it was funding in as little as 4 months, in 2023 it was averaging 6 – 8 months, but now the industry has seen processing times rise to 12 – 18 months; the government/IRS is very backlogged. Waiting for your ERC refund requires patience and understanding we have no control over how fast the IRS/Treasury processes your file. Any company that says “they can guarantee a quick filing and fast processing timeline” you should be very concerned to work with; as there is NO fast track system to get your ERC refund to fund quicker. They are typically processed in the order received; according to the IRS.

Is the ERC refund TAXABLE?

YES. Once you have received your ERC refund you have to pay taxes on the refund. THE TAXES YOU PAY COMES FROM THE ERC REFUND YOU RECEIVED. You DO NOT pay taxes out of pocket. For example, John receives $105,000 in an ERC refund. His corporate tax returns are amended for 2021 to pay the taxes on the ERC refund he received. His taxable rate is determined in this example at 22%. Thus $23,100 will be sent back to the IRS/government from the $105,000 he received. Again, the taxes you pay on the ERC refund comes from the refund you receive; it is not paid out of pocket. We have seen tax liabilities as low as 8% to as high as 33%; all companies are different. Some businesses had huge losses reported during the COVID years which could greatly reduce their tax liability on the ERC received while others businesses did not. If you would like 1800ERC.com to facilitate your amended 2021 tax return to pay the taxes on the refund we can do so at an additional charge. We typically charge $850 to as high as $2,500 for large companies over 50 employees. You are not obligated whatsoever to use us. Many clients choose to use us, as we are well versed in filing the amended return to reflect the ERC refund received. If your business is a NON PROFIT with a 501-3C designation (ex: churches, private schools (not federal or state), non profit organizations, etc.) then the ERC refund is NOT taxable; however the organizations tax return for 2021 need to be amended to reflect the ERC refund received.

Why can’t I have my own accountant file? Why use 1800ERC.com?

First, your CPA/Accountant should have already calculated if you qualify for the ERC refund; this program has been around for years. There are tens of thousands of pages of tax code. We specialize in the ERC refund calculations. Some accountants actually refer clients to us. Secondly, your accountant usually handles business income tax returns, personal returns and not necessarily your payroll tax returns where the ERC refund is determined. Lastly, almost all accountants will charge you a fee upfront; 1800ERC.com only get’s paid after you have physically received your refund in hand. Plus we wait with you for 12 – 18 months, as long as your file takes for the IRS to process.

Will I sign a service agreement?

Yes, but only AFTER we run your calculations for your ERC refund and if you wish to move forward. Once we run the numbers and you decide to move forward; then we will send you our service agreement to esign. It will clearly outline our fee and it is paid AFTER you have received your ERC refund in hand. Never before. It also includes a personal guarantee you will be signing. Why a personal guarantee? Because we are trusting that you will do the right thing and pay us once you received your refund. We are doing all the work on your file and trusting you will have integrity to pay the fees we are owed. You are required to notify your customer service representative assigned via email within 5 days of receiving your refund.

If I already received the ERC refund, can I apply again?

No, you can only receive the ERC refund one time.

When does the ERC refund expire?

The deadline to file for the ERC refund is April 15, 2025 for the 2021 tax year. The program has now closed and the IRS/Treasury is not accepting any NEW ERC filings.

Is there a MINIMUM size company you work with & what W2 employees are eligible for the ERC refund?

We can help a company as small as a 1 W2 employee, file for the ERC to a company as large as 500 employees. There are rules regarding eligible W2 employees for the ERC refund. For example, business owners with 50 percent or less ownership interest may be included as a qualified W2 employee for ERC purposes. However you have to also consider indirect ownership through family members. For example, John and Sue Smith are married, and own their company together each owns 50% of the company. They each are paid through W2 wages and pay payroll taxes. The ERC refund guidelines will NOT allow us to use these 2 owners although they are 50% equity owners, pay payroll taxes and on W2; they are indirectly related because they are married. Let’s look at another example. John Smith & Roger Jones are business partners each owning 50% of the company. They are high school friends, not related and started their business together. They receive a W2 wage, pay payroll taxes, have no children/relatives working for the company and their wages are ALLOWED to be included in the ERC calculations. Here’s one last example. John Smith owns 100% of the company and he is the only employee of the company. He collects a W2 wage, pays payroll taxes on his wage, etc. Unfortunately, John Smith in this example still CANNOT qualify for the ERC since he owns more than 50% of the company. Our online application will ask you questions regarding who owns the business, what are the business owner(s) equity position(s) (ex: 50%) and if they have any relatives working for the company; so your ERC refund calculations are done correctly. Employees of the business owner that are related (wife/spouse, daughter, son, etc.) to the business owner CANNOT be included in the ERC calculations.

I started my business in 2022, 2023 or 2024 – can I still qualify for the ERC?

No, the ERC refund is for the years 2020 & 2021. If you DID NOT have a business in 2021 then you should not apply. The 2020 year for the ERC refund has already expired. Only the 2021 year for the ERC refund remains and expires April 15, 2025. If you had W2 employees on payroll in 2021 and your business was affected by COVID (see options/ways to qualify on our application page); then you should complete an online application.

Can I file for the ERC refund if I own multiple companies?

Yes, if both businesses were impacted by COVID (see the 3 ways to qualify on our website or application page). You would simply complete our online application, 1 online application for each company.

I want to speak to someone over the phone?

Once you submit your COMPLETE application, within 1 business days we should have an answer on what that ERC refund amount would be. You will be emailed the information and then you will then be assigned a customer service representative. Your customer service representative will go over the amounts and answer any questions you may have. Nothing is automatically filed. But the initial process of running the numbers is all done online through your online application.

Filing as an ERC Startup Business

If your business started operations/services to the public between Feb 15, 2020 and December 2021 you can file for the ERC Startup Refund. It requires than you had a gross annual income of less than $1 million per year. The ERC refund for a ERC Startup Refund filing is capped at a maximum of $50,000 per quarter for Q3 2021 & $50,000 per quarter for Q4 2021; a maximum payout of $100,000.

Can a NONPROFIT (church, organization, school, etc.) file for the ERC refund?

Yes, a nonprofit (501-3C designation ex: church, non profit organization, private school) can file for the ERC refund; just like a C Corp, Sub S Corp, LLC, LP etc. Non profits do not have to pay taxes on the ERC refund received; but they have to amended their corporate tax return for 2021 to reflect the ERC refund received.